A Detailed Overview of Secured Credit Card Singapore Options for Enhanced Credit History Control

A Detailed Overview of Secured Credit Card Singapore Options for Enhanced Credit History Control

Blog Article

Charting the Path: Opportunities for Charge Card Access After Personal Bankruptcy Discharge

Browsing the world of debt card gain access to post-bankruptcy discharge can be a difficult task for individuals looking to rebuild their economic standing. From safeguarded credit score cards as a tipping stone to potential paths leading to unsecured debt opportunities, the journey towards re-establishing creditworthiness needs cautious consideration and notified decision-making.

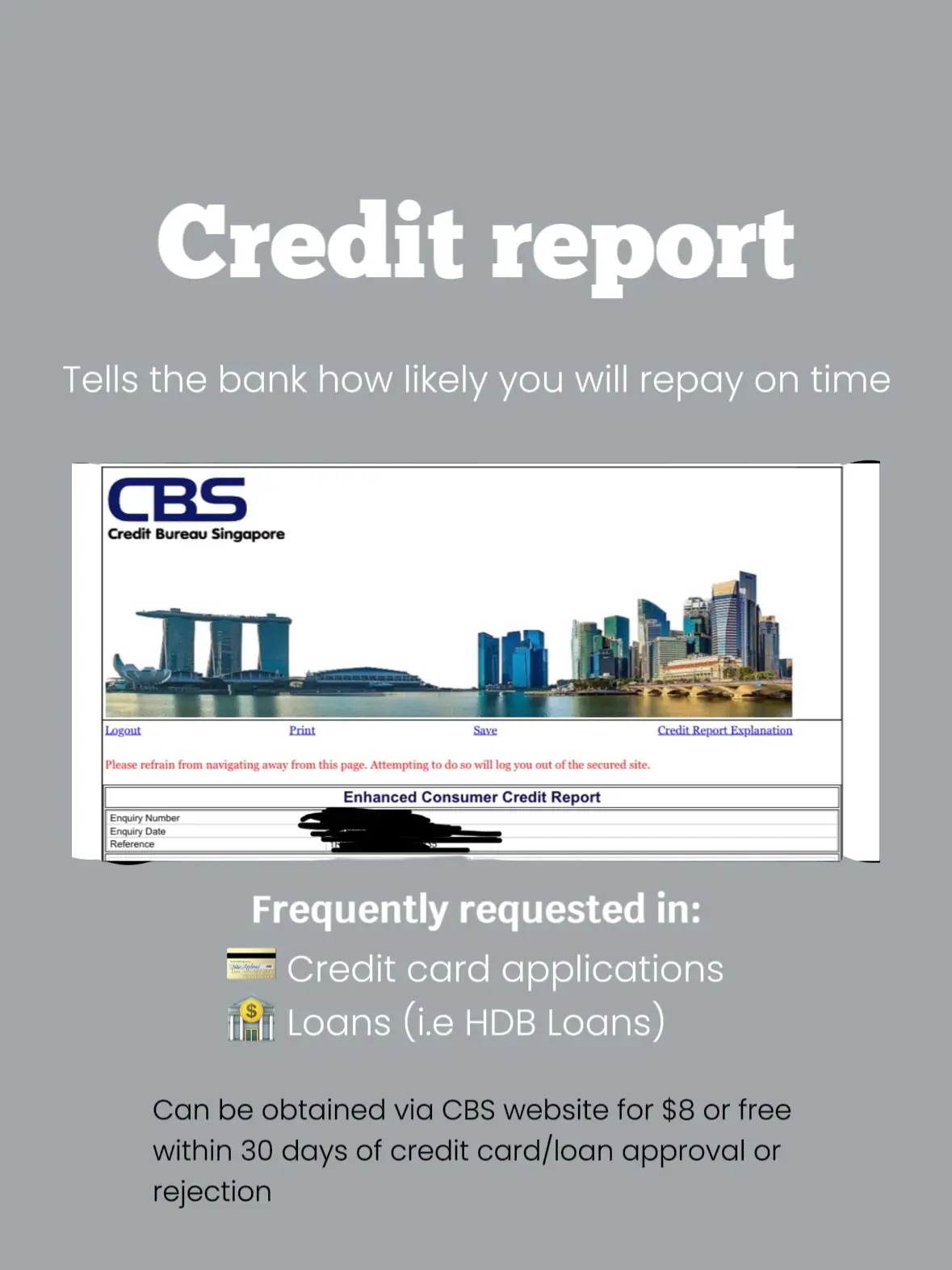

Comprehending Credit Rating Essentials

A credit history score is a mathematical representation of a person's credit reliability, showing to lending institutions the degree of risk associated with prolonging debt. Several aspects add to the estimation of a credit rating score, including payment history, amounts owed, size of credit report history, new debt, and kinds of credit rating made use of. The amount owed relative to offered credit, likewise understood as credit rating usage, is another important aspect influencing credit report scores.

Secured Credit Report Cards Explained

Safe bank card provide a valuable financial tool for people wanting to rebuild their credit rating complying with an insolvency discharge. These cards call for a down payment, which typically identifies the credit scores restriction. By making use of a secured bank card sensibly, cardholders can demonstrate their creditworthiness to prospective lenders and progressively boost their credit scores rating.

One of the vital advantages of safeguarded bank card is that they are much more accessible to people with a restricted credit report or a ruined credit history score - secured credit card singapore. Given that the credit scores limit is safeguarded by a down payment, providers are extra happy to accept candidates who might not get conventional unsafe bank card

Credit Score Card Options for Reconstructing

When looking for to rebuild debt after insolvency, discovering various credit rating card alternatives tailored to people in this monetary circumstance can be beneficial. Guaranteed credit rating cards are a popular option for those looking to rebuild their credit score. Another option is coming to be a licensed customer on a person else's credit scores card, allowing people find more to piggyback off their credit score history and possibly improve their very own score.

Just How to Get Approved For Unsecured Cards

To receive unsafe bank card post-bankruptcy, people need to show better credit reliability with responsible economic management and a history of on-time settlements. One of the key steps to get approved for unprotected credit rating cards after personal bankruptcy is to consistently pay costs on time. Timely settlements display obligation and dependability to prospective lenders. Maintaining low bank card balances and avoiding accruing high levels of debt post-bankruptcy additionally improves creditworthiness. Keeping track of credit scores reports regularly for any kind of errors and disputing errors can additionally boost credit rating, making people much more appealing to bank card providers. Additionally, individuals can take into consideration looking for a protected charge card to rebuild credit scores. Protected bank card require a money deposit as collateral, which lowers the danger for the provider and enables people to demonstrate liable charge card usage. Gradually, liable monetary behaviors and a favorable credit report can lead to certification for unprotected credit history cards with better benefits and terms, aiding individuals reconstruct their financial standing post-bankruptcy.

Tips for Liable Credit Card Usage

Building on the structure of improved credit reliability developed through liable economic administration, people can boost their total financial well-being by executing essential ideas for accountable credit card use. Additionally, maintaining a low credit history utilization ratio, ideally below 30%, demonstrates accountable credit scores use and can favorably influence credit report ratings. Refraining from opening up numerous brand-new credit rating card accounts within a short duration can stop prospective credit see post history score damage and too much financial obligation build-up.

Final Thought

In conclusion, people that have actually declared personal bankruptcy can still access charge card via various alternatives such as protected bank card and reconstructing credit scores (secured credit card singapore). By understanding credit report fundamentals, qualifying for unsafe cards, and exercising responsible debt card usage, individuals can slowly restore their credit reliability. It is essential for individuals to thoroughly consider their financial circumstance and make notified choices to boost their credit standing after bankruptcy discharge

Several factors contribute to the computation of a credit rating rating, including payment background, amounts owed, size of credit score history, new credit score, and kinds of credit history utilized. The amount owed loved one to offered credit score, also recognized as credit score usage, is one more essential factor influencing credit report scores. Checking credit score reports on a regular basis for any kind of errors and disputing mistakes can better boost credit scores, important link making people much more appealing to credit scores card providers. Furthermore, preserving a low credit rating usage ratio, ideally below 30%, shows liable credit scores usage and can positively influence credit rating scores.In final thought, people that have actually submitted for bankruptcy can still access credit score cards through various alternatives such as protected debt cards and restoring debt.

Report this page